Pragmatic Solutions for Solvency Capital Requirements at Life Insurance Companies: The Case of Spain | Semantic Scholar

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

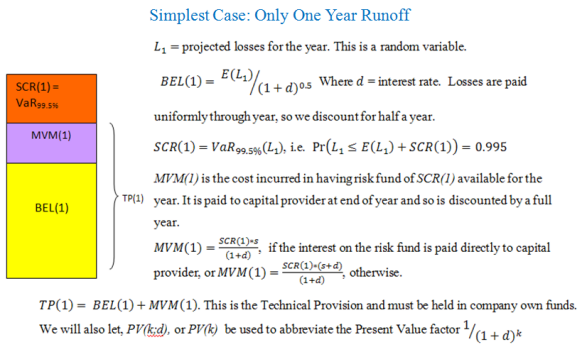

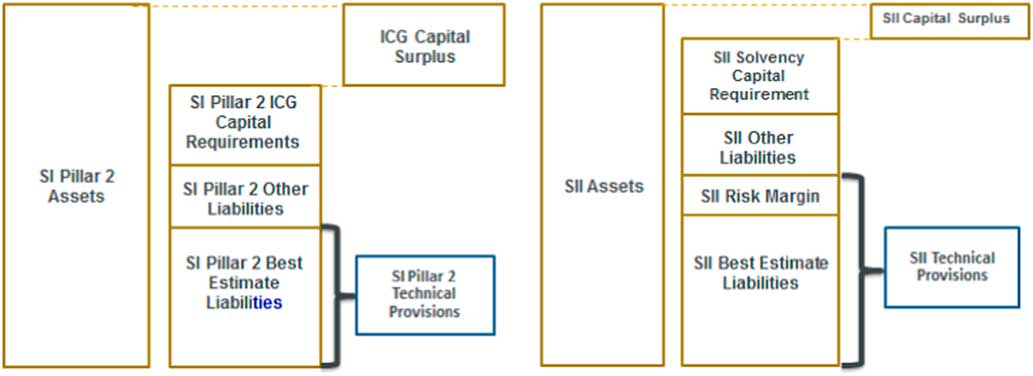

Recalculation of the Solvency II transitional measures on technical provisions | British Actuarial Journal | Cambridge Core

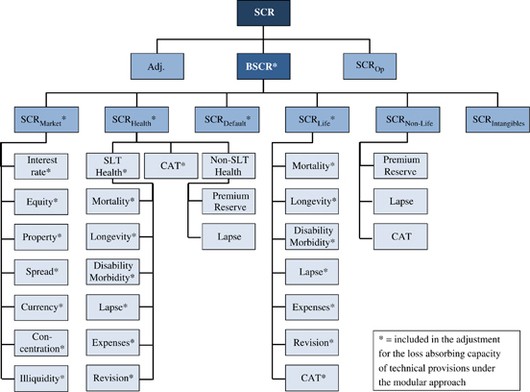

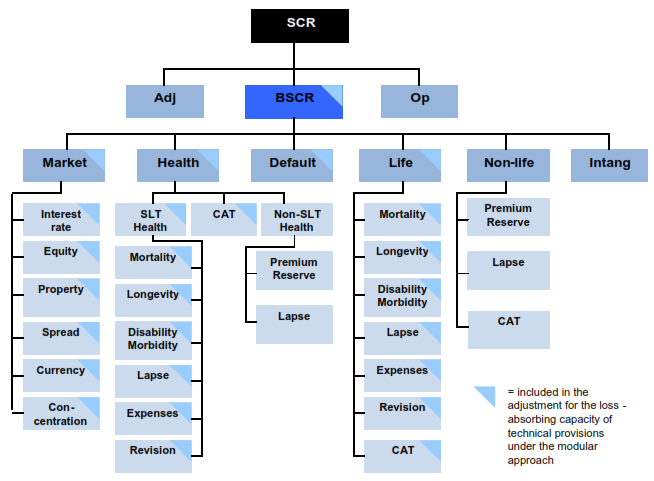

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

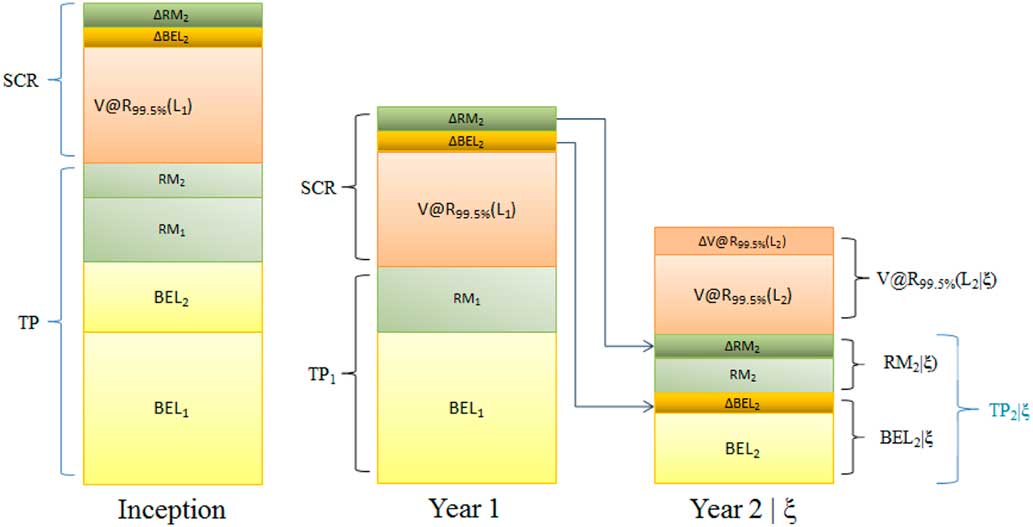

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Solvency II Standard Formula Structure Source: European Insurance and... | Download Scientific Diagram

1. The overall structure of the standard formula | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

![PDF] Calculation of solvency capital requirements for non-life underwriting risk using generalized linear models | Semantic Scholar PDF] Calculation of solvency capital requirements for non-life underwriting risk using generalized linear models | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/601693297ab402176f3fe0ca21befdcde6cc77fd/4-Figure2-1.png)